Do you have Great Lakes student loans?

If so, you aren’t alone.

Unless you earned scholarships or benefitted from generational wealth, there’s a good chance that taking out student loans was a costly but necessary decision to cover your tuition and living expenses. After all, nearly 45 million Americans have student loan debt.

In this post, you’ll learn more about the Great Lakes company that manages your federal loan, review the options for paying off your student loan debt, and find answers to some of the commonly asked questions asked my other Great Lakes borrowers.

While paying off your student debt won’t happen overnight, hopefully by the end of the article, you’ll feel confident that you’re taking steps in the right direction.

My Great Lakes student loans review

Let’s start this Great Lakes review by looking at a quick overview of the company:

- Great Lakes Educational Loan Services, based in Madison, Wisconsin, was established in 1957.

- Great Lakes is a loan servicing company. They help the US government with the administration and management of its federal loans program.

- In 2018, Great Lakes Educational Loan Services merged with Nelnet to become the largest company responsible for managing government-based student loans.

- It is estimated the parent company handles more than 40% of all student loan payments in the United States.

But that’s enough background on Great Lakes. You want your relationship with the company to be a short and painless one. What does it take to get your student loans paid off?

How to pay off your Great Lakes loans

If you have student loans with Great Lakes, then having a specific debt repayment plan in place is an important step in learning how to manage your money.

Repayment options with Great Lakes loans

Great Lakes offers a few different debt repayment options. Each repayment plan has own pros and cons. The right repayment option as a Great Lakes borrower will depend on your own personal situation:

- Standard Repayment Plan: This is the default option. You’ll make the same monthly payments over the life of your Great Lakes loan. Because you’ll pay less student loan interest with this option than the others, it’s generally the best option if you can afford it.

- Graduated Repayment Plan: With this option, your payments start small and increase every two years over the life of the loan. This repayment makes sense if you may struggle to make your payment now, but expect to have more money later. You’ll pay more interest over the life of the loan as the earlier payments cover less of the principal.

- Income-Driven Repayment: If you are eligible for this plan, your monthly payment will be based on your personal income. The less you earn, the less you pay. If your income increases, you may lose eligibility for this plan before your payments are complete.

Should you only make the minimum payment?

It depends on your financial circumstances and goals.

Paying an additional $20 or $50 per month can reduce the duration of your student loans by months – even years.

This allows you to pay less interest over the life of the loan. Paying off your debt early also allows you to start putting that allotted money toward other financial goals.

After all, do you really want to be making student loan payments to Great Lakes in your 40s?

But even if you’re in a position to pay additional money toward your student loans each month, that doesn’t necessarily mean it’s the optimal decision for your financial situation:

Is paying off your student loans faster the best option for you?

Reasons to pay only the minimum payment

There are a few reasons you may want to consider making only the minimum student loan payment each month:

You can’t cover your other bills. Make sure you can pay all of your existing expenses before putting extra money toward your student loans. The last thing you want is to start carrying a credit card balance because you made an extra debt payment your budget wasn’t prepared for.

You still need to build an emergency fund. Even if paying off your student loans is your top priority right now, you never know when you might be hit with unplanned expenses. This is one of the many reasons to save money now – even if you don’t think you need it.

Aim to save up three to six months of your monthly expenses, but even setting aside $500 or $1000 in a savings account can give you peace of mind.

You’re not taking advantage of your employer’s 401k match. If your employer offers a match on your 401k contributions, you’ll want to make sure you’re contributing whatever amount they’re willing to match if you can afford it.

Although the exact employee match may vary by company, you’re effectively doubling your money instantly – something that could take 7-10 years through investing.

You are carrying other high-interest debt. Even if you have the highest credit score possible, your credit card interest rate is almost certainly higher than the interest rate on your student loans. If you have any credit card debt whatsoever, you’re going to save money on interest paid by putting extra money toward your student loan debt instead.

You can get a better return through investing. This typically only makes sense if you have a low interest rate on your student loans (most of my Great Lakes federal loans are near 4%). If can earn 7-10% through investing in the stock market, your investment returns will outpace the rate at which you’re paying interest on student loans.

That being said, there’s a huge benefit to knocking out the emotional burden and financial commitment of debt even if you’re missing out on potential investing returns.

How can you pay off your student loans faster?

If you have an emergency fund in place, no credit card debt, and you’re taking advantage of your employer’s match, then perhaps it is time to speed up your student loan repayment plan!

Here are a few tips that can help you pay off your Great Lakes student loans more quickly:

- One of the simplest ways to put more money toward your student loans is to increase your income. Ask yourself: is it time to ask for a raise at work? If it’s been at least 10-12 months since your last raise, it may be time to bring up the conversation (be sure to read our guide).

- If increasing your income at work isn’t an immediate option, you may want to consider earning extra money with a side hustle. You can learn how to make money on Upwork through freelancing, participate in the gig economy, or temporarily work a part-time job (if you’re looking for things to do when bored on the weekend, why not earn some money?).

- Once a year, you may find yourself with a tax refund from Uncle Sam. Do you normally treat yourself to a vacation or discretionary purchase when you get your refund? Give yourself the gift of debt freedom by putting a portion of that money toward your student loans instead.

- Find ways to save money through frugal living. Review your monthly and annual subscriptions, and consider what money you may be able to put toward your Great Lakes student loans instead.

- Continue learning about personal finance. You can watch personal finance TED talks and read blogs and books about money. By becoming more financially savvy, you can identify additional opportunities to earn and save more money.

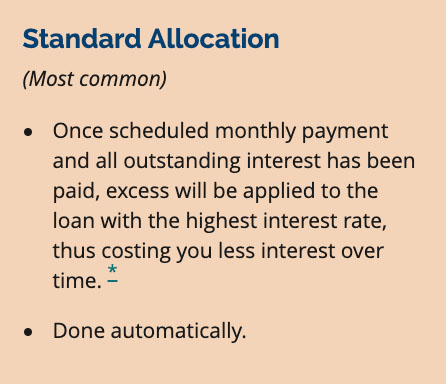

If you do start paying above the minimum payment, make sure all of the additional money is going toward the loan with the highest interest rate. This will help you to pay the least amount of interest on your loan.

You can log into your Great Lakes account to confirm your Excess Payment Preference is the Standard Allocation (which makes sure you’re paying the least interest possible).

Common problems with Great Lakes

I took out my first student loan with Great Lakes in January 2014. Since then, I haven’t personally experienced any difficulties with my repayment, the company, or their website.

Unfortunately, that hasn’t been the case for all Great Lakes borrowers. Here are a few common problems with Great Lakes that you should at least be aware of.

Incorrect information submitted to credit bureaus

Student loans are included on your credit report. Failure to make your student loan payment to Great Lakes on time can negatively impact your credit score and affect your ability to qualify for other loans or the lowest interest rates. In some rare instances, Great Lakes has inadvertently but incorrectly submitted false information to the credit bureaus with regards to late payments and delinquency.

Loan payments aren’t applied correctly

By default, any additional money paid toward your Great Lakes student loan debt should be paid toward the loan with the highest interest rate (unless you’ve changed this preference on their website). However, there have been some borrowers who have noticed that additional funds were not properly applied to the correct loan, and that they’ve needed to reach out to customer support to correct each of these payments.

Difficulty with changing repayment plans

Enrolling in a different repayment plan or deferring your repayments can have a huge impact on your personal finances. It’s not always a smooth transition to move from the Standard Repayment Plan to another Great Lakes repayment plan. Keep a close eye on your account to make sure your request has been processed correctly.

How to identify and fix problems with Great Lakes loans

Have you experienced any problems with your Great Lakes student loans?

If you aren’t sure, you may want to start by checking your credit report. This can be done securely and at no cost through AnnualCreditReport.com.

After requesting your credit report, you’ll want to make sure that Great Lakes has the correct loan amount and payment history.

In addition to reviewing your credit report, you can also identify any possible issues through the Great Lakes website. After logging in, you can view your payment schedule, make sure autopay is configured correctly, explore repayment options, and more.

Find any issues with your Great Lakes account and status?

While Great Lakes does offer a Knowledge Center with helpful content, you may need to contact Great Lakes directly with your specific question or concern.

Great Lakes contact information

There are multiple ways that Great Lakes borrowers can contact the company with their questions about repayment options, deferring your payments, and more.

What’s the Great Lakes student loans phone number?

You can reach Great Lakes by calling (800) 236-4300. Company representatives are available from Monday through Friday between 7 am and 9 pm (Central time).

What’s the Great Lakes student loans mailing address?

While this address shouldn’t be used for submitting loan payments, you can reach Great Lakes for general correspondence through their post office box:

Great Lakes

PO Box 7860

Madison, WI 53707-7860

What’s the Great Lakes student loans email address?

You can communicate directly with Great Lakes online by emailing them at [email protected].

They also have a secure contact form embedded on their website as well.

Conclusion

Whether you are a Great Lakes borrower or your loans are managed by another company, learning how to pay off your student loan debt can be overwhelming and intimidating.

If you have student loans with Great Lakes, you’re one of millions of individuals taking the first steps in mastering personal finance for college grads. After reading this article, hopefully you feel better prepared to pay off your debt, address potential problems that may arise, and reach out for help when you need it.

Just like a college degree can open up new windows of opportunity, the knowledge and habits gained from paying off your student loans can positively shape your financial future as well.

What advice would you give to others who have Great Lakes student loans?