Generational wealth is the financial legacy that most people want to leave for their families.

Even though personal finance is a considered a “personal” thing, there are many areas in which money management is a family affair.

An inheritance, passing wealth from one generation on to another one, is the most obvious example:

However, your family’s financial legacy extends even beyond the passing of wealth or debt.

Whether you realize it or not, your family’s financial legacy has also influenced your:

- Financial literacy/education

- Financial goals

- Financial values

There are many different reasons why you may be interested in the topic of generational wealth.

Perhaps you want to:

- Make peace with your finances after years of bad decisions

- Learn how to get the most out of an inheritance or some other windfall

- Create a secure and abundant financial future for your future family

In this post, you’ll learn the definition of generational wealth, get an idea of how much money you need to reach your goal, and explore basic strategies to build and protect that wealth.

What is generational wealth?

Let’s start by defining generational wealth.

Generational wealth is assets – often cash, real estate, business ownership, or collectibles – that can be passed down from one family generation to the next.

Commonly recognized examples of families who possess generational wealth often come from backgrounds of:

- Government/political royalty

- Tech and business moguls

- Professional athletes

- Popular culture celebrities

But just because these are popular examples doesn’t mean they are the best or most common illustration of what legacy wealth looks like.

Many people who understand the difference of rich versus wealthy also embrace the idea of “stealth wealth,” or keeping your riches hidden from society by avoiding extravagant consumerism and consumption.

You probably have friends whose families are part of the million dollars club whether you realize it or not!

How much do you need for “generational wealth?”

The amount of generational wealth needed to reach your lofty financial dream depends on two things:

- The lifestyle you want to provide for your family

- The size of your family

Most personal finance enthusiasts go off the 4% rule: as a general rule of thumb, you can withdraw 4% of your nest egg indefinitely without worrying about running out.

Let’s say you become a millionaire during your lifetime. After you pass away, each child receives $500,000. Based on the 4% rule, each child could withdraw $20,000 a year from that point forward without touching the principal.

Not exactly the windfall you’d wanted to give?

As you can see, building generational wealth isn’t easy. Passing along any inheritance can have a positive financial impact on future generations.

But if you’re interested in reaching financial independence and then providing that same privilege to your family indefinitely, it’s doing to take tens – or hundreds – of millions of dollars.

How can you build generational wealth?

Whether your goal is to provide your future offspring with a huge fortune or just provide some additional financial security, the key is to start acquiring and building as many assets as possible.

There are many different approaches you can take to doing this. Over time, you’ll want to diversify the sources of your wealth to help reduce the risk of a family financial crisis if things take a turn for the worse.

However, don’t delay your wealth-building by letting fear and uncertainty scare you. Remember these basic investment truths:

- The market always goes up over the long run

- There is no way to predict the next downturn

- Even if you start investing at a terrible time, you will still be better off than waiting to invest until the perfect time

Building generational wealth for your family is very much on the opposite side of the spectrum as short-term investing.

A very basic plan should be to:

- Create an emergency fund if you haven’t already

- Contribute to any employer-matched investments

- Pay off your debt – especially high-interest debt like credit cards

- Max out your contributions to your retirement accounts

- Acquire other assets

The first three or four steps may seem boring, but it’s important that you build a solid financial framework first!

There are many different types of assets you can acquire. You can find examples of people building generational wealth through corporate stock, book or music royalties, restaurants or car washes…

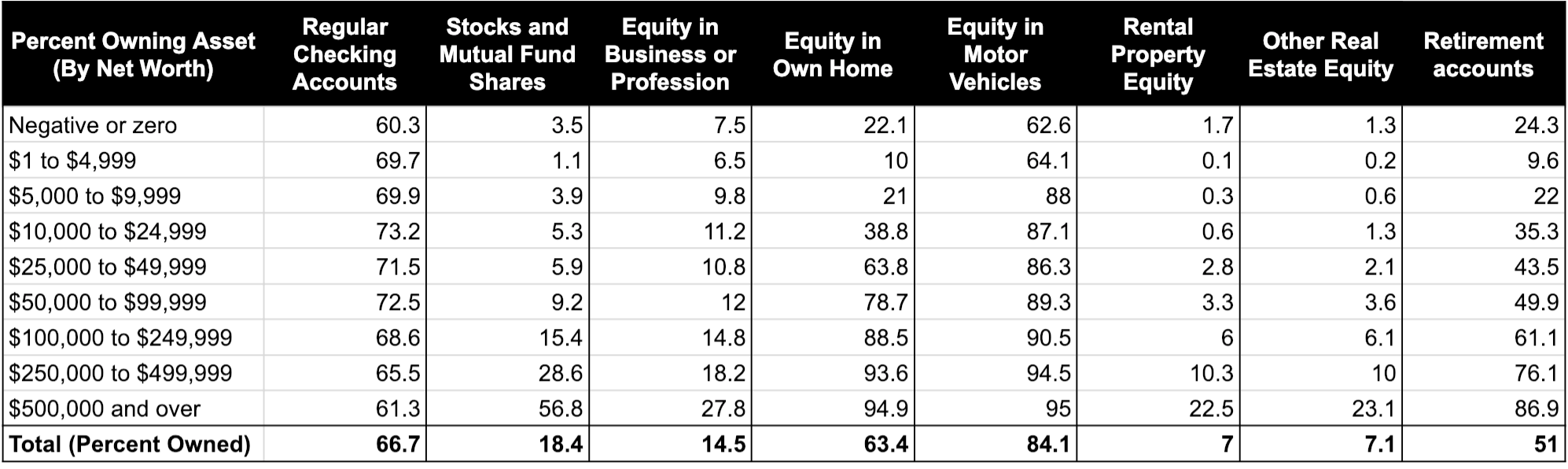

Take a look at the 2014 census data on asset ownership.

Generally, assets such as a checking account or motor vehicle equity remain fairly consistent across net worth classes.

Three of the major asset classes that separate the wealthiest households from those with less include:

- Stocks and mutual fund shares

- Rental properties

- Business equity

Just the difference in asset ownership between the highest tier ($500k+) and the next tier ($250-499k) is astonishing:

Households with a net worth of $500,000 or higher were twice as likely to own stocks and mutual fund shares, twice as likely to own rental property, and 50% more likely to have equity in a business.

How do families lose wealth?

Of course, just because generational wealth is intended to last forever, doesn’t mean that will be the case.

Just like many lottery winners don’t know what to do after winning the lottery, family wealth can also be easily squandered away.

That’s what happens when your financial legacy fails to consider the non-monetary components of a financial legacy:

- Financial literacy

- Goals

- Values

If you want to create and preserve a financial legacy that will last for generations, you’ll need to educate yourself on the basics of financial management, work consistently on long-term financial goals, and make sure your goals and behaviors are in line at all times.

(Or at least most of the time… everybody is going to make a financial splurge every now and then!).

Conclusion

There are many reasons why you may be interested in the idea of generational wealth. Maybe you want to preserve what you’ve been given… Or perhaps you’re motivated to change your family’s financial fortunes.

To build your financial legacy, start by educating yourself on financial principles and building a strong financial foundation.

From there, you can focus on acquiring and building assets: investing in stocks, buying rental properties, or starting a business can all be a great place to start.

And remember, passing on generational wealth is just one potential component of your financial legacy:

You can leave an excellent financial legacy without passing along a large inheritance!

What type of financial legacy would you like to leave for your family?