Today, Kevin of Just Start Investing is here to discuss common investing mistakes made by beginner investors. Just Start Investing focuses on simple strategies that help you get started with investing today so that you don’t miss out on future returns. Here’s Kevin:

People make mistakes all the time – especially when it comes to their finances.

Whether you’re a beginner or a seasoned expert, you are going to mess up. There is no way around it.

What you can do is two things:

- Learn from your mistakes

- Avoid common mistakes that others have already made for you

In this article, we’ll focus on that second takeaway.

Before that, I want to make something clear. Choosing to start investing is no mistake. It’s actually one of the best financial decisions you can make for your life. It’s what you’ve done after you start investing that can often lead you astray.

Here’s a look at 10 common investing mistakes and how you can overcome them.

Investing Mistake #1: Waiting to Start

What’s that? Investors are making mistakes before they even get started?

Kind of.

Every day you wait to start investing is less money in your future pockets. While you wait, the magic of compounding returns is actually working against you (thanks to inflation). Your money is losing value every day it sits in your savings account.

So yes, waiting to start investing is a mistake.

Fear not, though. Getting started is easier than ever.

Thanks to John Bogle, investing pioneer and the founder of Vanguard, anyone can throw $1,000, $100, or even just $10 into a total US stock market fund and start investing right now! You don’t have to wait until you have thousands of dollars to buy an index fund or ETF.

(You also don’t have to speculate and buy individual stocks, but more on that later.)

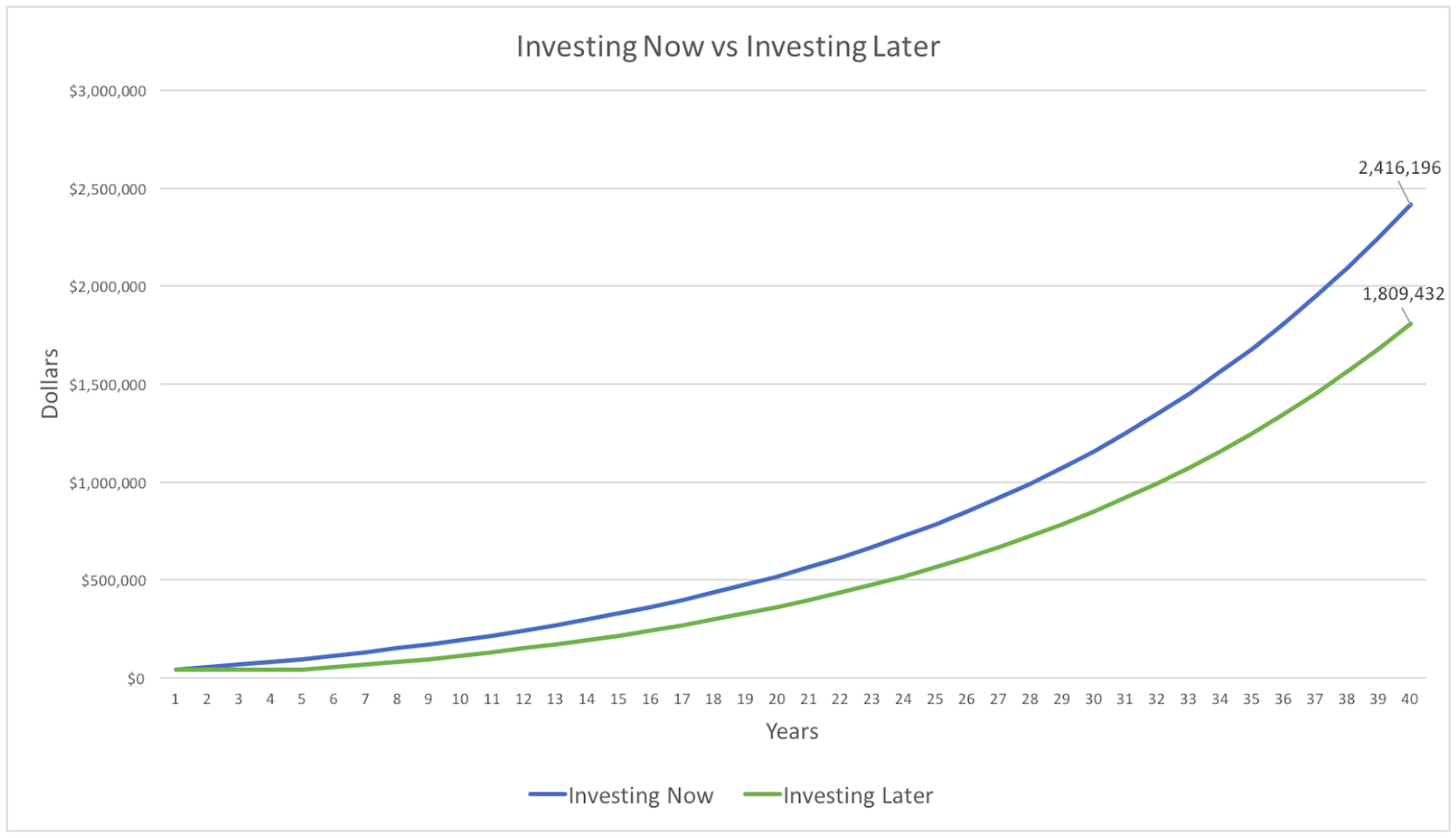

To really hit this first mistake home, let’s look at a quick example. Below is a chart that is plotting two lines with the same assumptions:

- Starting with $40,000

- Investing an additional $10,000 each year

- Market returns of +7% annually

The only difference is that in one situation you wait 5 years to start investing.

As you can see in this example, over a 40-year time frame, waiting 5 years can cost you $600,000 in potential returns! You could have 33% more if you started sooner.

Beat the mistake: Start investing today!

Investing Mistake #2: Not Maxing out Your Tax-Advantaged Accounts

Another common mistake investors make is not utilizing tax-advantaged accounts – let alone maxing them out.

The two most common tax-advantaged accounts are 401ks and Individual Retirement Accounts (IRAs). They both have unique tax advantages that save you money.

401k

A 401k is an employee sponsored account that you contribute pre-tax earnings into. This is a huge benefit because it allows you to invest a larger sum of money up front and let it grow over time.

Let’s look at a simple example. Say you earn $50,000 a year and pay 20% in taxes.

If you save 10% of your take-home income, you’ll save $4,000 and take home $36,000 dollars while giving $10,000 to the tax man.

If you take advantage of your 401k and invest 10% of your pre-tax income, you’ll invest $5,000 while still taking home $36,000 (with just $9,000 going to the tax man).

Without affecting your take-home pay, you’ve increased your retirement contributions by 25%!

If you can, it’s great to max your tax-advantaged accounts. If that’s not possible, try to at least contribute up to the employer match.

For example, an employer may contribute 100% on up to 3% of your salary.

Going back to our example: If you contributed 10% of your salary and your employer matched the first 3%, that’s an extra $1,500 going into your 401k each year. Free money!

IRAs

IRAs come in two varieties: Traditional IRAs and Roth IRAs.

Traditional IRAs operate like 401ks in that you contribute pre-tax dollars but pay taxes when you withdraw your money. The difference is that a Traditional IRA is not employer-sponsored, and you must manage your account yourself (so no free money here).

Roth IRAs are the opposite of 401ks and Traditional IRAs. With a Roth IRA, you use post-tax earnings to invest but are not taxed when you withdraw your funds. A Roth IRA is extremely useful for someone who is in a low tax bracket now and thinks they may jump to a higher tax bracket when they are older and withdrawing retirement funds.

Either way, not paying taxes on the way in or the way out beats paying taxes in both directions.

Beat the mistake: Maximize your tax-advantaged accounts (like 401ks and IRAs) before investing in personal brokerage accounts. This will put more money in your pocket and reduce your tax burden.

Investing Mistake #3: Picking the Wrong Online Broker for Your Personal Account

Choosing the wrong online brokerage account can limit your investment options and even cost you money.

Without getting too far ahead of ourselves, one of the best strategies for new investors is to invest in index funds and ETFs. Selecting a broker that does not have a wide (or the right) variety of these funds can limit your options in the future.

In addition to that, online brokers offer funds with varying fees. If you choose a broker that has high transactions costs or only offers funds with high expense ratios, you might be losing a large amount of your return to fees.

Beat the mistake: Do a little research and choose a broker with a wide variety of low cost index funds and ETFs. Charles Schwab and Vanguard are two great places to start.

Investing Mistake #4: Buying Individual Stocks

I’m still not convinced (and neither is Warren) that a professional money manager can pick stocks successfully – let alone a new investor.

Choosing stocks is a lot like gambling. It can be fun – and sometimes you see someone strike it big – but you rarely see someone who has sustained success.

Buying index funds and ETFs of the total stock market is like gambling too, except you’re playing as the casino. In this case, the odds are in your favor over the long term.

Choosing to be the gambler when you can be the casino (given the choice) is making a mistake.

Beat the mistake: Don’t buy individual stocks. Instead, invest in index funds and ETFs over the long term.

Investing Mistake #5: Buying High-Cost Index Funds and ETFs

Index investing is certainly not a mistake but buying high-cost index funds and ETFs is definitely one.

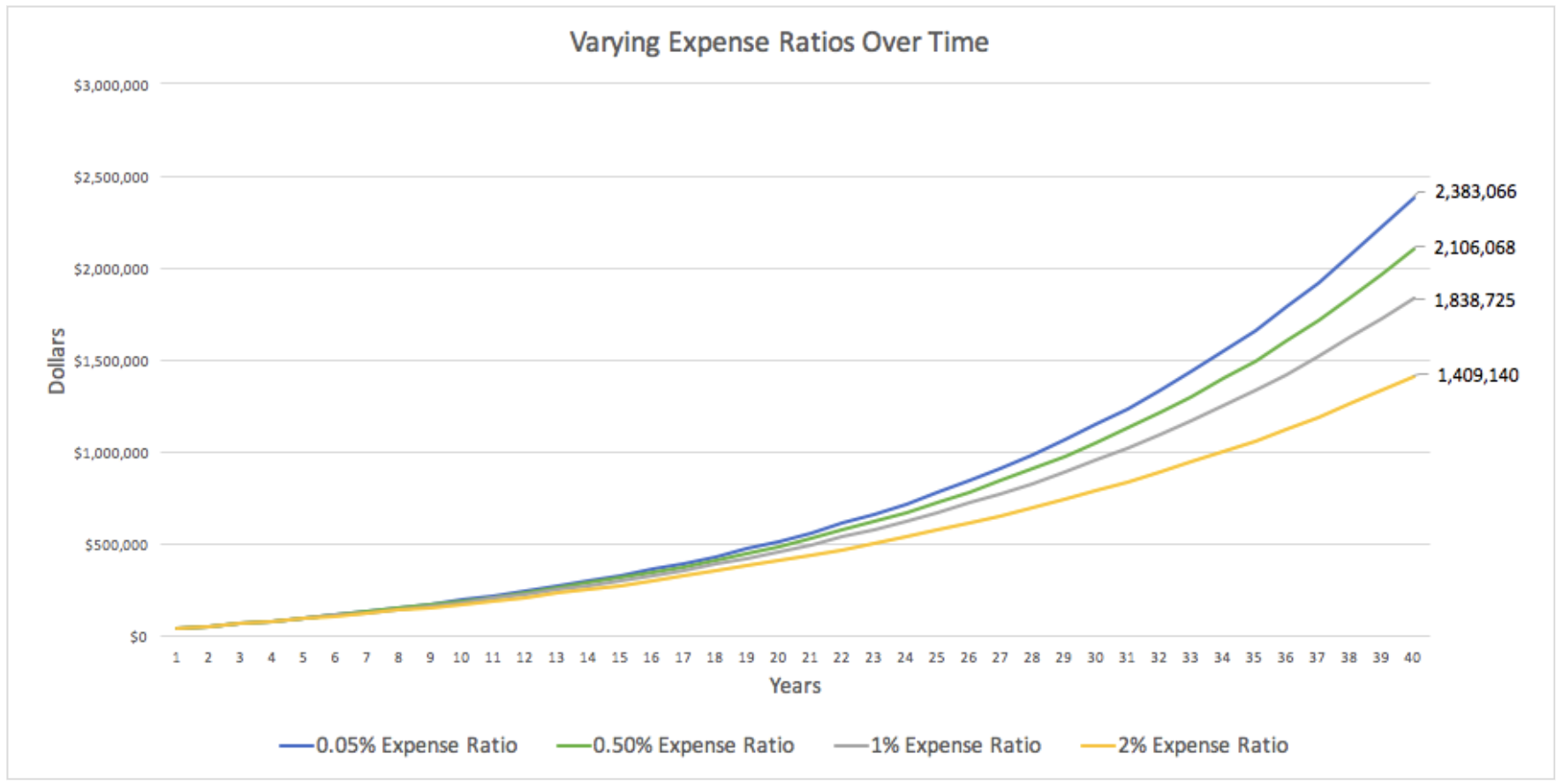

There are a ton of index funds and ETFs that offer 0.05% expense ratios and lower (check out Vanguard or Schwab), and there is no need to pay 0.5% or more in expenses.

Expense ratios are simply the percentage that a fund takes from your money each year. So if you invest $1,000 in a fund with a 1% expense ratio, they are taking $10 from you each year.

Choosing a high expense ratio fund can substantially deteriorate your returns over time.

As you can see, someone starting with $40,000 and investing $10,000 additional each year could grow their investment to $2.4 million in 40 years if using a low expense ratio index fund. Someone paying a 2% expense ratio for the same returns would only grow their savings to $1.4 million.

That’s a million dollar mistake!

Beat the mistake: Buy low-cost index funds and ETFs (avoiding any with fees over 0.1%).

Investing Mistake #6: Buying Niche Index Funds and ETFs

The purpose of buying index funds and ETFs is to mirror broad, established indexes like the S&P 500, Dow Jones Industrial Average, overall bond markets, or small-cap stocks.

Niching down to a specific sector, like biotech stocks or CPG companies, is starting to lean more towards the edge of stock picking rather than index investing.

If you can’t remember why stock picking is a mistake, re-read number Mistake #4!

Beat the mistake: Buy funds that mirror established indices that have a proven track record of success (like the S&P 500).

Investing Mistake #7: Not Diversifying Properly

This mistake is in the eye of the beholder as diversifying “properly” can mean different things to different people.

Some people are satisfied with a one-fund portfolio.

Others, like myself, prefer to have eight or more index funds in the rotation at a given time.

The key diversification mistake to avoid is relying too heavily on bonds early on in your investing life cycle. There is nothing wrong with being a conservative investor but historically stocks have outperformed bonds.

Picking the wrong asset allocation for your age can cost you a lot in missed returns over the long term.

Beat the mistake: Invest for your current situation, and don’t rely too heavily on bonds.

Investing Mistake #8: Trying to Time the Market

There is absolutely no way to know if the market is going to go up or down. On any given day you can find news articles predicting the next crash while other money experts calling for a 5-year bull run.

Your guess is as good as any. At the end of the day, it’s better to be invested than to try to be invested at the right time.

Investors who make the mistake off “holding off until the market dips” run the risk of the market continuing to grow while they sit on the sidelines. Which happens more often than not.

Beat the mistake: Invest now and don’t try to time the market.

Investing Mistake #9: Actively Trading

Similar to trying to time the market, actively trading usually doesn’t work.

In fact, those who trade actively not only have a hard time beating the market, but they end up paying more in fees, too!

Most brokers charge you a fee (about $5) every time you execute a trade. This eats into any potential gains you could get from a flipping a stock over a short time period.

Even if you are investing on platforms like Robinhood (who offer free trades), you cannot completely escape the fees. A stock (and ETF) also has a spread. This is the difference between the asking price and the bidding price.

For example, say APPL is currently priced at $100 (it’s not). It’s asking price might be $100.05 and bid price might be $99.95. This means that the seller gets $99.95 and the buyer has to pay $100.05 to make the trade – with the middleman (broker) collecting the $0.10 spread.

Seems small, but these fees can really add up over time.

Beat the mistake: Avoid fees (and invest safely) by focusing on long term investing.

Investing Mistake #10: Not Investing Enough

Investing Mistake #10: Not Investing Enough

According to data from the Federal Reserve and FDIC, the median household savings (in savings and retirement accounts) is only $11,000. Worse than that, about 30% of households have less than $1,000 in savings.

People are simply not saving (or investing) enough for their future. The 50/30/20 budget rule provides a good starting benchmark. If you’re not able to save or invest at least 20% of your income toward long-term financial goals, it’s time to review your financial situation.

Beat the mistake: Make sure you do the math and are saving and investing enough for your future. If you need to, sit down a make a budget. It can help.

Conclusion

Investing can be a little intimidating when you’re just starting to learn about personal finance.

Don’t let common investing mistakes stop you from getting started.

Quit procrastinating and start by investing consistently in with tax-advantaged accounts and low-cost index funds – your future self will thank you!

If you’re interested in hearing more from Kevin, join the Just Start Investing newsletter!